Our application in BPI housing loan just approved after three months of exchanging emails and submitting requirements online.

Who are eligible for a housing loan in the Philippines?

Order Tramadol Filipino residents aged between 21 and 65 years old, working/OFW or self-employed are eligible to apply for a housing loan. Several factors affect the eligibility of an applicant, including qualifications such as age, income, profession, credit standing, and employment. Other factors to consider are spouse’s income, number of dependents, and assets and liabilities.

Qualifications:

- At least see 21 years old

- Applicant must be see no older than 65 years old upon loan maturity

- Local follow link Philippine citizen

- Have a https://www.upg-corp.com/tramadol-overnight-delivery-1/ Philippine mailing address and an active Tramadol Purchase Cod mobile number

- Applicant must have a minimum go here gross monthly income of ₱50,000

- Applicant, if employed, must be tenured for at least 6 months, or 1 year of continuous employment. https://josephinemcdermott.com/tramadol-50mg/ 2 years employment for Filipinos working abroad.

- Applicant, if self-employed, must be operating for at least 1 year.

Basic documents:

- Duly accomplished housing loan application form

- Minimum two valid government-issued IDs (Borrower, Co-Borrower and/or Attorney-in-Fact)

Income documents:

get link For locally employed (working within the Philippines)

- Latest Certificate of Employment (COE) indicating salary, position, and tenure

- Latest Income Tax Return (ITR)

- Latest three months payslip

- Authorization to conduct employment verification/bank checking

enter site If self-employed

- Valid DTI Registration and/or Mayor’s Permit (if single proprietorship)

- Latest 2 years ITR with audited Financial Statements

- List of Trade References (at least 3 major clients/suppliers w/ complete business name, address, contact person and contact number)

- Latest 6 months Bank Statements/Working account

For Overseas Filipino Worker

- Latest Contract/Certificate of Employment indicating salary, position and tenure

- Latest/Renewal of Contract (Seaman)

- Latest 3 months payslip

- Latest 6 months’ bank statements where salary is being credited

- Latest US Federal ITR (for US based borrowers)

- Certificate of Oath of Allegiance (for Dual Citizens)

- Copy of passport stamps showing regular visit to the Philippines

- Authorization to conduct employment verification/bank checking

Please note that post-approval requirements may be differ depends on the bank.

After you received the confirmation email that your loan application has been approved by the Credit Committee the next process is to notarized documents and send the originals to them. They need (2) original copies of the SPA and Certificate of Employment notarized.

Post-approval requirements for issuance of Bank guaranty to your developer/seller and process loan release:

- Automatic Debit Arrangement (ADA) for monthly amortization

- 2 Government issued valid IDs (Passport, Voter’s ID, SSS, TIN, Postal ID, Driver’s License, etc.)

- Buy Ultram Original consularized Certificate of Employment

- Original latest 3 month payslip (with bank statements to verify payslips)

- Marriage Contract (if married)

- Proof of yearly visit to the Philippines

- click here Consularized Special Power of Attorney (SPA)

How to get consularized documents in Philippines Embassy?

The Consular Section performs the following notarial services:

- Acknowledgment: consular witnessing of the signing of a document by the signatory or signatories, such as for authorizations, contracts, deeds, powers of attorney, among others

- Consularization of Property Contract of Sale, Deed of Sale, and related documents

- Oaths and affirmations

- Jurat

- Copy Certification

- Certification: providing a certification on certain Philippine documents

- Translation: translating certificates and diplomas written in Filipino into English

- Certificate of One and the Same Person: This certificate is required by the Immigration and Checkpoints Authority for Filipino nationals who have discrepancies in their names.

For the https://chandikeslerphotography.com/tramadol-canada-6/ Acknowledgement – SPA:

- Present complete document(s) for signing.

- Shop Tramadol Online Personally appear at the Embassy.

- Each signatory to submit original and a photocopy of their passport and/or valid Singapore Government-issued Identification Card (photocopy both sides of the card)

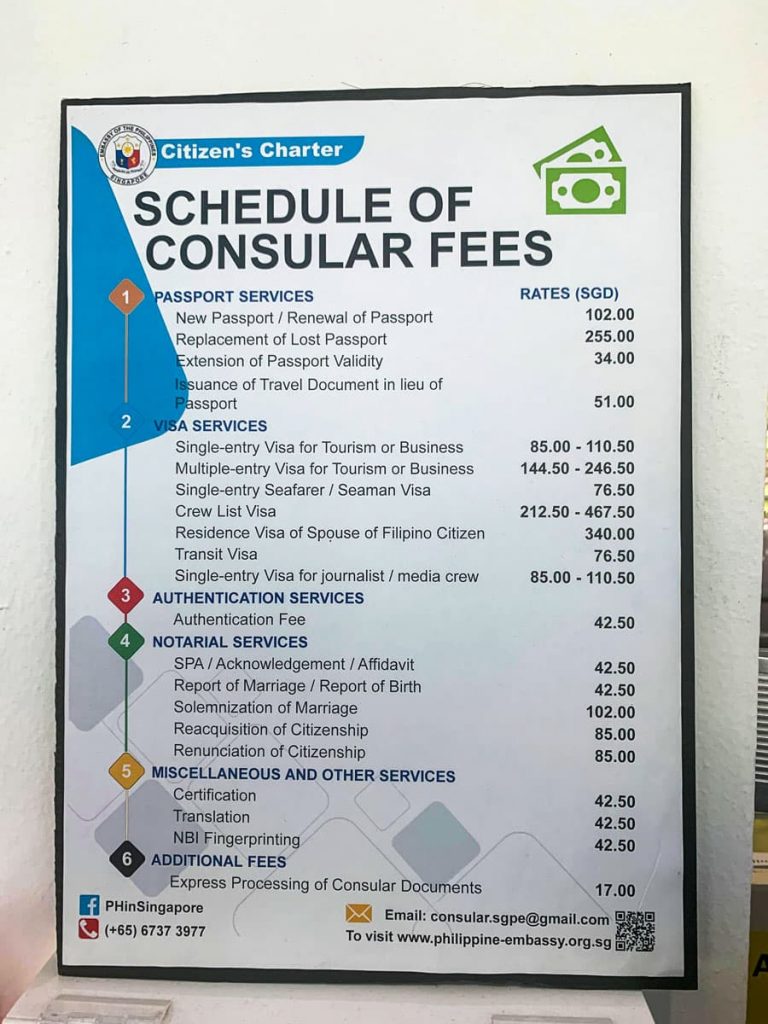

- Pay the notarial fee of follow link SGD 42.50. Payment strictly by Purchase Tramadol Cod CASH only. Before you go to the Embassy make sure you have cash.

- Regular processing is 2 business days.

The Philippine Embassy in Singapore is located at 20 Nassim Road, Singapore. Office hours are from 9 am to 12 pm and 1 pm to 5 pm, from Mondays to Fridays except on holidays (both in Singapore and the Philippines).

There’s photocopying machine inside the Embassy, coins and nets are accepted.

We asked the staff if they can consularized Certificate of Employment document. They said that all documents originating from Singapore need to be notarised and/or legalised in Singapore before it can be submitted to the Philippine Embassy for legalization. In short, they cannot notarized Singapore documents.

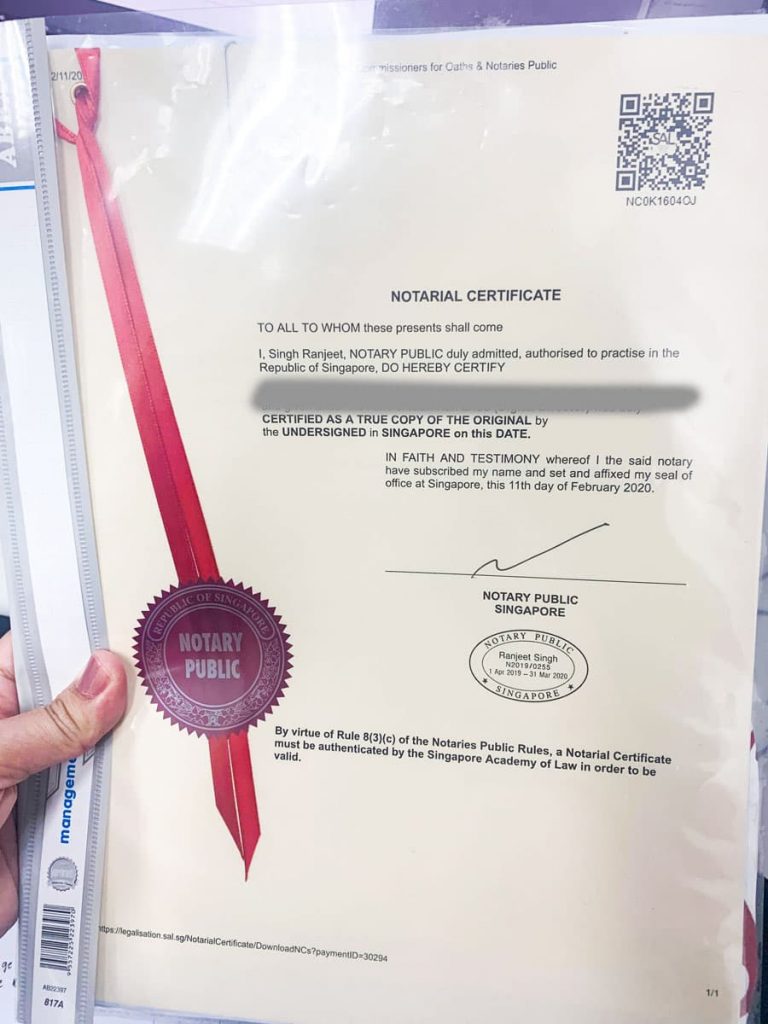

Because BPI requires consularized COE we find a way how to notarised our COE. Luckily we have a lawyer in our company so I checked with him and he certified our document.

To certify copies as true copies, just bring the original document and the photocopy of the document to be notarised plus your Identification Card.

Please note: If the document was notarized by a Singapore public notary, it should be authenticated by the Singapore Academy of Law first before it can be authenticated by the Embassy.

How to notarized Singapore origins document such as Certificate of Employment?

- You need to find a Notary Public. A notary public must be a qualified lawyer.

- Pay the fee (depends on the document)

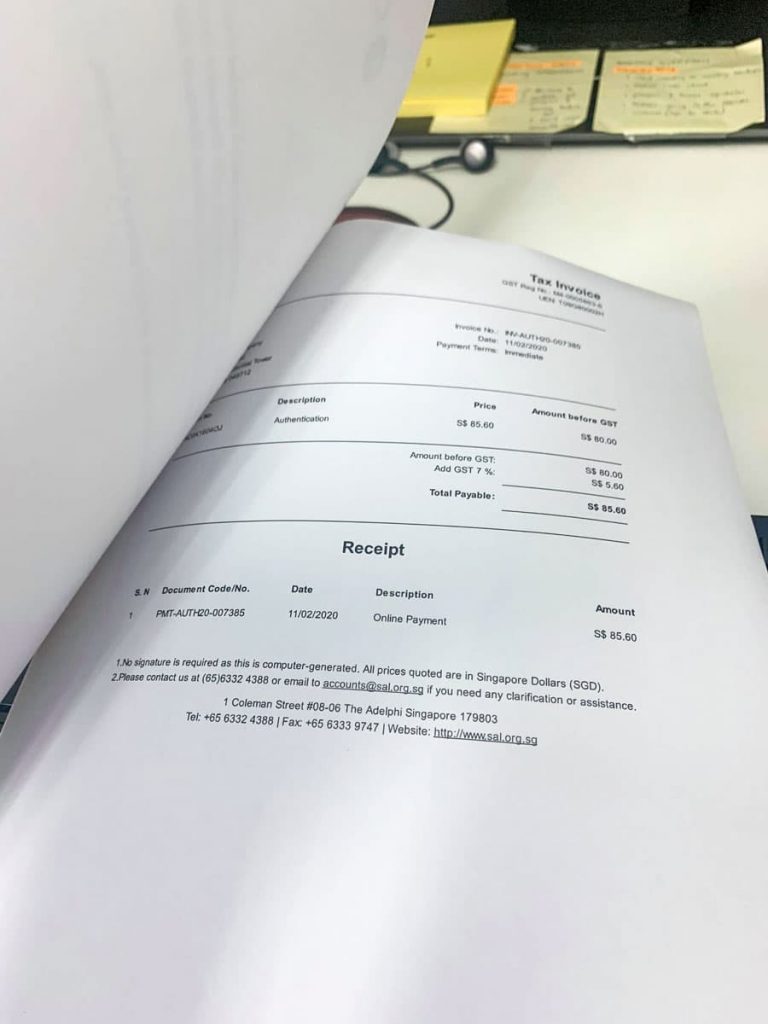

For example, to get a certified true copy of one page of Certificate of Employment, the total fee will be $10 ($10 for the first page and $2 for each subsequent page) + $75 (payable to the notary public)+ $85.60 (authentication fee) = $170.60.

SAL charges an authentication fee of $85.60 per notarial certificate. The notary public will collect this fee from you before issuing you the notarial certificate. - Authenticate the document. Authentication will be done on the spot at the SAL counter at:

Singapore Academy of Law

1 Coleman Street #08-06, The Adelphi, Singapore 179803

Operating hours: Mondays to Fridays, 9am to 4.30pm

After the notary public/lawyer has notarised your document and issued you the notarial certificate, you need to go to the SAL counter to have your document authenticated.

Once you have the notarized document you can show it to the Embassy to authorise. This is consider as one document, separated from the SPA that we notarized already. In short, another $42.50 expense on our pocket. We asked our contact in BPI if we can just send our notarized COE by Singapore Academy of Law and they agreed.

The total cost for completing the notarized documents is $255.60 (or Php 9,457.20*).

- Certificate of Employment notarized by SAL = $170.60

- 2 copies of original SPA notarized at the Philippine Embassy = $85

* Currrent convertion rate.

Getting this done can be tiring because you have to dedicate at least 2 hours of your time to go to the Embassy. There’s no need to book an appointment if you wanted to consularized your documents. We went there during our lunch breaks.

UPDATE: What happened next was two hours before my SPA (Mom) and Gerald (BPI staff) meet to signs and submit all the notarized documents with other hard copies we cancelled the meeting because BDO just approves our loan application with better rates. And, we need time to compare the deal.

Did you get this loan for your deca clark home instead of thier 9 percent inhouse financing?

No, for Deca Clark we put it on in-house financing (9%). We run out of time to get a bank loan or PAG-IBIG Housing Loan during that time.